Fund-by-fund analysis (what to know before you click INVEST)

1) ICICI Prudential Focused Equity Fund

Category / Style: Focused / Diversified Equity

Why it did well (9-month driver): Concentrated holdings benefitted from select large-cap and mid-cap rallies; active management and stock selection produced alpha.

AUM & structure: Large AUM (check live NAV on AMC page) — see ICICI fund page for latest NAV and fund manager details.

Risk: Higher volatility due to concentration; can underperform in broad market selloffs.

Who it suits: Investors with 5+ year horizon who can stomach drawdowns and want active concentrated bets.

How to invest: Prefer direct plan, growth option for long-term wealth building; SIP for rupee-cost averaging.

Quick checklist: confirm expense ratio, check top 5 holdings & allocation, ensure fit with portfolio core/satellite approach.

2) Kotak Focused Fund

Category / Style: Focused Equity (concentrated portfolio)

Why it did well: Selective large-cap and midcap bets regained momentum; concentrated strategy magnified upside during the rally.

Performance note: Historically shows cyclical outperformance and underperformance — discipline and timing matter.

Risk & Suitability: High volatility; suitable as a tactical allocation for investors who believe in manager’s process.

How to invest: Use SIP to smooth entries or small lump sums if you time around corrections; prefer direct plans.

3) Invesco India Midcap Fund

Category / Style: Midcap equity

Why it did well: Midcaps often lead rallies in a growth cycle; selective midcap exposure produced double-digit gains in 6–9 month frames. Performance metrics show strong mid-term numbers.

Risk: Midcap funds carry company-specific risk and liquidity risk; wider NAV swings possible.

Who should invest: Investors targeting high growth with 5–7+ year horizon and ability to tolerate volatility.

How to invest: SIPs recommended; cap exposure to a percentage of overall equity holdings.

4) Helios Large & Mid Cap Fund

Category / Style: Large & Mid Cap blend (relatively newer fund)

Why it did well: Focused picks across large and midcap names during market recovery; relatively recent launch but attracted investor flows after early performance.

Notes: Newer funds can be nimble but have shorter track record — validate consistency over 1–3 years.

Risk & Suitability: Good for investors wanting a blended large+midcap approach but accept higher short-term swings.

5) Invesco India Large & Mid Cap Fund

Category / Style: Large & Mid Cap (blended)

Why it did well: Top-down cycle calls + bottom-up stock selection across caps; consistent process gives balance between stability and growth.

Risk & Suitability: Moderate-high risk; appeals to investors who want growth but lower volatility than pure midcap.

How to invest: Direct growth option recommended for long-term capital appreciation.

How to read these returns (important investor checklist)

- Nine-month returns are a short window. They show momentum, not guaranteed future performance. Evaluate 3-5 year and 7-10 year returns too.

- Check fund category performance vs category average. A fund beating peers short-term may still lag category averages long-term.

- Look under the hood: top 10 holdings, sector allocation, turnover ratio, expense ratio. Concentrated funds amplify both gains and losses.

- Match to goal & horizon: aggressive midcap-focused funds need 5–7+ year horizon; focused funds need conviction & risk tolerance.

- Tax & exit loads: Short-term capital gains tax and exit loads matter for lump-sum traders.

Portfolio allocation suggestions (sample)

- Conservative investor: 0–10% in any single focused/midcap fund; keep core in large-cap index or diversified large-cap funds.

- Balanced growth investor: 10–20% allocation to a mix of 1 focused + 1 large & mid fund, rest in diversified large-cap & debt.

- Aggressive investor: 20–40% in midcap/focused funds with 5+ year horizon, but rebalance annually.

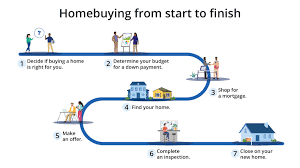

Practical buying guide (step-by-step)

- Check the fund’s direct plan NAV & expense ratio on AMC website or platform.

- Scan the last 3-year rolling returns and alpha vs category benchmark.

- Review the top 10 holdings and recent portfolio churn. If concentration is high, treat as tactical.

- Choose growth option for long-term compounding; choose SIP for disciplined investing.

- Use a small initial SIP to test the fund and scale up after 6–12 months if comfortable.

Risk warnings & compliance note

- Not investment advice: This article is educational. Past returns don’t guarantee future results. Always cross-check NAVs, expense ratios, and scheme documents and consult a certified financial advisor for personalized allocation.

- The five funds were highlighted by market coverage and fund pages as the top performers in the trailing 9-month window; confirm live numbers before investing.

- Suggested FAQ

- Q: Are 9-month returns reliable for choosing a mutual fund?

A: No — they show momentum. Check 3- and 5-year returns and consistency of alpha. - Q: Should I move all my money into a top 9-month performer?

A: No — avoid concentration risk. Use these funds as part of a diversified plan aligned to your horizon.

Post Comment