Investment Mistakes That Can Cost You Lakhs in the Long Run

Avoid costly investment mistakes that drain your wealth. Learn about emotional investing, lack of diversification, timing errors, and more. Build smarter, safer long-term returns.

Building wealth through investing is not just about choosing the right stocks, funds, or real estate—it’s equally about avoiding mistakes that can derail your financial growth. Many investors lose lakhs of rupees not because of bad luck but due to avoidable investment mistakes. Whether you’re a beginner or seasoned investor, understanding these pitfalls is crucial to achieving long-term success.

In this article, we’ll highlight the most common investment mistakes that can cost you big, explain why they happen, and provide practical ways to avoid them.

1. Investing Without a Clear Goal

The first major mistake investors make is not defining their financial goals. Without a roadmap, your investment journey becomes directionless.

For instance, if you invest in equity mutual funds without a clear time horizon, you may panic during short-term market dips and sell at a loss.

How to avoid it:

- Define short-term (1–3 years), medium-term (3–7 years), and long-term (7+ years) goals.

- Match your investments with your goals—debt funds for short term, equity for long term.

- Review your portfolio annually to stay aligned with your objectives.

A goal-based approach ensures that every rupee invested works toward a specific purpose—be it a house, education, or retirement.

2. Ignoring Diversification

Many investors believe in putting all their money into one “winning” asset—say, a trending stock or real estate property. This lack of diversification increases risk.

If that single asset underperforms, your entire portfolio suffers.

Diversification means spreading your investments across equity, debt, gold, real estate, and even global markets to balance risk and reward.

How to avoid it:

- Follow the 60:30:10 rule (Equity:Debt:Gold) based on risk tolerance.

- Invest in mutual funds or ETFs that provide built-in diversification.

- Review sector exposure regularly; avoid being overly dependent on one industry.

Remember, diversification doesn’t ensure profit—but it minimizes potential loss.

3. Timing the Market

Many investors try to “time” the market—buy low, sell high. In reality, even professional fund managers find it difficult to predict market highs and lows consistently.

If you wait for the “perfect” time, you might never invest at all.

How to avoid it:

- Adopt Systematic Investment Plans (SIPs) to invest regularly, regardless of market conditions.

- Focus on time in the market, not timing the market.

- Keep a long-term perspective—market volatility is temporary, but growth compounds over time.

By staying invested, you benefit from rupee cost averaging and power of compounding.

4. Overlooking the Power of Compounding

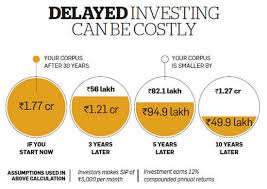

One of the greatest mistakes is underestimating the power of compounding—where your returns generate their own returns over time.

For example, investing ₹10,000 monthly at 12% annual return for 25 years can grow to over ₹1 crore. But delaying by just five years can reduce that to around ₹55 lakhs!

How to avoid it:

- Start early, even with small amounts.

- Stay invested for the long term.

- Reinvest your earnings rather than withdrawing them.

Compounding rewards patience, not perfection.

5. Letting Emotions Drive Decisions

Fear and greed are the two biggest enemies of investors.

During market crashes, fear makes people sell at losses. During rallies, greed pushes them to buy at inflated prices. Both lead to poor long-term returns.

How to avoid it:

- Set automatic SIPs to stay disciplined.

- Avoid checking portfolio value daily—it fuels anxiety.

- Stick to your plan unless your goals or risk profile change.

Successful investors like Warren Buffett advise being “fearful when others are greedy and greedy when others are fearful.”

6. Ignoring Inflation

Inflation silently eats into your savings. If your investment earns 6% and inflation is 7%, your real return is negative.

Many people make the mistake of keeping large sums in savings accounts or fixed deposits without considering inflation.

How to avoid it:

- Choose instruments that beat inflation—equity funds, index funds, or REITs.

- Maintain a mix of fixed-income and growth assets.

- Regularly review and rebalance your portfolio to stay inflation-protected.

Inflation may be invisible—but its impact on your future wealth is very real.

7. Chasing High Returns Without Understanding Risk

When investors hear about someone doubling their money in six months, they jump in without research.

High returns often come with high risk. Many get trapped in Ponzi schemes, crypto hype, or unregulated platforms, losing their hard-earned money.

How to avoid it:

- Invest only in regulated and transparent products.

- Understand risk-return correlation—there’s no free lunch in investing.

- Always perform due diligence or consult a SEBI-registered financial advisor.

It’s better to earn steady 10–12% safely than to risk everything for quick, uncertain gains.

8. Not Having an Emergency Fund

Before investing, you must have a safety cushion for unexpected events like job loss or medical emergencies.

Without an emergency fund, you may be forced to liquidate your investments at a loss during crises.

How to avoid it:

- Maintain at least 3–6 months’ expenses in a liquid fund or savings account.

- Keep it easily accessible but separate from regular investments.

- Refill it after every withdrawal.

This ensures you never disturb your long-term investments for short-term needs.

9. Ignoring Tax Implications

Many investors look only at gross returns and forget to calculate tax-adjusted returns.

For example, a 7% FD return taxed at 30% gives an effective return of only 4.9%.

How to avoid it:

- Prefer ELSS mutual funds for tax saving under Section 80C.

- Use NPS or PPF for long-term, tax-efficient returns.

- Understand capital gains tax on equity, debt, and real estate before investing.

Smart investors don’t just earn—they plan taxes efficiently to maximize net gains.

10. Not Reviewing and Rebalancing the Portfolio

Even a well-planned portfolio needs regular reviews. Market conditions, risk tolerance, or goals change over time.

Ignoring portfolio rebalancing can lead to asset imbalance—too much equity exposure during bull runs or too little during corrections.

How to avoid it:

- Review your portfolio every 6–12 months.

- Rebalance back to target asset allocation.

- Exit underperforming or irrelevant investments.

Regular maintenance keeps your portfolio aligned with your goals and market realities.

Conclusion

Avoiding these common investment mistakes can save you lakhs of rupees and help build a secure financial future. Investing isn’t just about earning returns—it’s about being consistent, disciplined, and patient.

Start early, diversify smartly, plan your taxes, and review regularly. Most importantly, don’t let emotions control your investment decisions.

When done right, your money works harder than you—and that’s the true power of smart investing.

For more such amazing content visit : https://newseeker.insightsphere.in/

Post Comment