Tax-Saving Investments: How ELSS Beats PPF and FD in 2025

Discover how ELSS beats PPF and FD as the best tax-saving investment option under Section 80C. Learn about returns, risks, lock-in, and growth potential for smart tax planning in 2025.

Why Tax-Saving Investments Matter

Every year, millions of Indians rush to invest before March 31 to save taxes — but many end up choosing traditional options like PPF and Fixed Deposits (FDs) just because they feel “safe.”

However, if you truly want to grow wealth and save taxes efficiently, it’s time to understand why ELSS (Equity Linked Savings Scheme) has become a smarter, modern choice.

This blog explains, in simple terms, how ELSS beats PPF and FD in returns, flexibility, lock-in, and long-term wealth creation — helping you plan your investments wisely in 2025 and beyond.

1. Understanding the Basics: What Are These Options?

a. ELSS (Equity Linked Savings Scheme)

ELSS is a mutual fund scheme that invests mainly in equity (stocks).

- It is eligible for tax deduction up to ₹1.5 lakh under Section 80C.

- It has a 3-year lock-in, the shortest among all 80C options.

- Returns are market-linked and can beat inflation.

Example: If you invest ₹1,00,000 in an ELSS SIP for 5 years, your corpus could grow to ₹1.8–₹2 lakh depending on market performance.

b. PPF (Public Provident Fund)

PPF is a government-backed savings scheme.

- It offers fixed interest (around 7.1%), reviewed quarterly.

- The lock-in is 15 years, but partial withdrawal is allowed after 7 years.

- Returns are tax-free, making it low-risk and safe.

c. FD (Fixed Deposit)

Bank Fixed Deposits are the most common investment in India.

- Offers fixed interest (6–7%), depending on tenure.

- Usually has a 5-year lock-in if you want tax benefits.

- Interest is taxable, reducing actual returns.

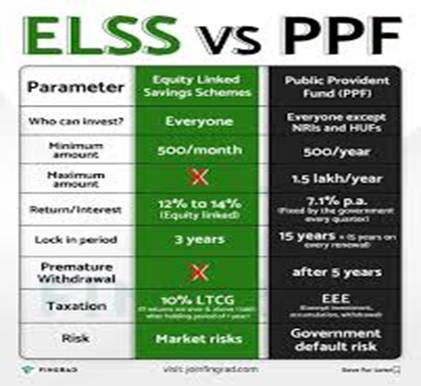

2. The Real Comparison: ELSS vs PPF vs FD

| Feature | ELSS (Equity Linked Savings Scheme) | PPF (Public Provident Fund) | FD (Fixed Deposit) |

| Lock-in Period | 3 years | 15 years | 5 years |

| Returns (Approx.) | 10–15% (market-linked) | 7.1% (fixed) | 6–7% (fixed) |

| Risk Level | Moderate to High | Very Low | Low |

| Tax under Section 80C | Up to ₹1.5 lakh | Up to ₹1.5 lakh | Up to ₹1.5 lakh |

| Liquidity | Medium (3-year lock) | Very Low | Low |

| Tax on Returns | LTCG: 10% above ₹1 lakh | Tax-free | Fully taxable |

| Ideal For | Long-term wealth growth | Ultra-safe savings | Short-term low-risk investors |

Conclusion:

ELSS clearly outperforms in terms of returns and flexibility, while PPF and FD are better for those seeking safety and guaranteed income.

3. Why ELSS Beats PPF and FD

(a) Shortest Lock-In Period

ELSS has only 3 years lock-in, compared to 15 years in PPF and 5 years in FD.

That means your money becomes available sooner, offering both liquidity and flexibility.

(b) Higher Returns Potential

Since ELSS invests in equities, it can deliver double or even triple the returns of traditional products over time.

For example:

- ₹1,00,000 in PPF at 7.1% grows to ₹2.84 lakh in 15 years.

- ₹1,00,000 in ELSS (12%) grows to ₹5.47 lakh in the same period.

This difference can completely change your long-term wealth trajectory.

(c) Power of Compounding via SIP

You can invest in ELSS through Systematic Investment Plans (SIPs) — small monthly amounts that benefit from rupee-cost averaging.

Even a ₹2,000 monthly SIP in ELSS can create ₹7–₹8 lakh in 10 years.

(d) Tax Efficiency

- Both ELSS and PPF qualify under Section 80C, but PPF interest is tax-free while ELSS gains are taxed only 10% beyond ₹1 lakh.

- FD interest is taxed as per your slab — so if you’re in the 30% bracket, it erodes real gains.

Thus, for someone earning ₹10–₹15 lakh annually, ELSS offers superior post-tax returns.

(e) Professional Fund Management

ELSS funds are managed by expert fund managers who analyze markets, sectors, and growth potential — unlike FDs or PPF, which are fixed.

This gives ELSS a performance edge in dynamic markets.

4. Common Myths About ELSS (and the Truth)

| Myth | Reality |

| ELSS is too risky | It carries moderate risk but can be balanced by long-term SIPs and diversification. |

| I’ll lose money if the market crashes | Only if you exit early; 3+ years horizon usually smooths volatility. |

| PPF is better because it’s government-backed | True for safety, but not for wealth growth. ELSS beats inflation. |

| Mutual funds are for experts | ELSS is beginner-friendly; SIPs make it simple for anyone to start. |

5. How to Plan Your ELSS Investment Smartly

Step 1: Define Your Goal

Are you investing for retirement, children’s education, or just tax saving? Your horizon matters.

Step 2: Choose Growth or Dividend Option

For long-term compounding, choose Growth Option.

Step 3: Go for SIP, Not Lump Sum

Start small — even ₹1,000 per month. It reduces risk and builds habit.

Step 4: Pick a Good Fund

Look for ELSS funds with:

- Consistent 5-year performance above 10–12%

- Strong fund manager record

- Low expense ratio (<1%)

Step 5: Stay Invested

The magic of ELSS lies in long-term compounding. Don’t exit after just 3 years; stay invested for at least 5–7 years for maximum growth.

6. Who Should Choose ELSS, PPF, or FD?

| Investor Type | Best Option |

| Young professionals (<35 yrs) | ELSS (growth-oriented) |

| Middle-aged with moderate risk | ELSS + PPF combination |

| Retirees or conservative investors | PPF or FD for capital safety |

| Salaried taxpayers | ELSS SIPs for monthly discipline + tax saving |

7. Final Thoughts: Build Smart, Not Safe

Safety is important — but in today’s inflation-driven world, safety without growth means loss of value.

If your goal is long-term wealth creation + tax saving, ELSS beats PPF and FD hands down.

It’s the perfect balance between risk, reward, and flexibility, making it an essential part of your financial plan in 2025.

So, before you rush to open another fixed deposit or PPF account this year — pause, analyze, and invest smartly through ELSS.

Quick Recap

- ELSS: High returns, short lock-in, market-linked growth.

- PPF: Safe, tax-free, long lock-in.

- FD: Safe but taxable and inflation-beaten.

Winner: ELSS — for smart, modern investors who want both tax saving and wealth creation.

“Start your ELSS SIP today and make your tax-saving investments work for your future — not just for your present!”

For more such amazing content visit : https://newseeker.insightsphere.in/

Post Comment